#401k account

Explore tagged Tumblr posts

Text

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

How to start saving for retirement

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over.

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

How To Save for Retirement When You Make Less Than $30,000 a Year

Workplace Benefits and Other Cool Side Effects of Employment

Your School or Workplace Benefits Might Include Cool Free Stuff

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Financial Order of Operations: 10 Great Money Choices for Every Stage of Life

Advanced retirement moves

How to Painlessly Run the Gauntlet of a 401k Rollover

The Resignation Checklist: 25 Sneaky Ways To Bleed Your Employer Dry Before Quitting

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 8: “I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?”

How Dafuq Do Couples Share Their Money?

Ask the Bitches: “Do Women Need Different Financial Advice Than Men?”

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Speaking of advanced money moves, make sure you’re not funneling money to The Man through unnecessary account fees. Roll over your old retirement accounts FO’ FREE with our partner Capitalize:

Roll over your retirement fund with Capitalize

Investing for the long term

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Stocks vs. Bonds

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Financial Independence, Retire Early (FIRE)

The FIRE Movement, Explained

Your Girl Is Officially Retiring at 35 Years Old

The Real Story of How I Paid off My Mortgage Early in 4 Years

My First 6 Months of Early Retirement Sucked Shit: What They Don’t Tell You about FIRE

Bitchtastic Book Review: Tanja Hester on Early Retirement, Privilege, and Her Book, Work Optional

Earning Her First $100K: An Interview with Tori Dunlap

We’ll periodically update this list with new links as we continue writing about retirement. And by “periodically,” we mean “when we remember to do it.” Maybe remind us, ok? It takes a village.

Contribute to our staff’s retirement!

Holy Justin Baldoni that’s a lot of lengthy, well-researched, thoughtful articles on the subject of retirement. It sure took a lot of time and effort to finely craft all them words over the last five years!

In case I’m not laying it on thick enough: running Bitches Get Riches is a labor of love, but it’s still labor. If our work helped you with your retirement goals, consider contributing to our Patreon to say thanks! You’ll get access to Patreon exclusives, giveaways, and monthly content polls! Join our Patreon or comment below to let us know if you would be interested in a BGR Discord server where you can chat with other Patrons and perhaps even the Bitches themselves! Our other Patrons are neat and we think you should hang out together.

Join the Bitches on Patreon

#retirement#retire#how to retire#retirement account#retirement fund#retirement funds#401k#403b#Roth IRA#Traditional IRA#investing#investors#investing in stocks#Capitalize#401k rollover#personal finance#money tips

440 notes

·

View notes

Text

made a phone call i'd been putting off for like two months, please clap

#been tryina get my paltry 401k rolled over to the place i now have a roth ira and screwed up who i needed them to make the check payable to#and the only thing worse than one (1) phone call with a retirement account provider is making the same call again.....#i got lucky today though there was like no wait which was one reason i was putting it off#anyway. then once it's in the new account i set up for it#i just have to call so fi to do the thing they claimed i could do where i pay a one time tax thing#and then i can put this in the other one as well...#isabel 2k24

68 notes

·

View notes

Text

just found out my bank is going to start charging $5 (i think per month but im not sure) if you have less than $500 in your account :) They’re just straight up stealing money from poor people at this point

#Meow.#I work a part-time minimum wage job‚ automatically have money from every paycheck put into a 401k…#And put $100 from each paycheck into a savings account. I would have to skip buying gas and food to keep my checking balance over $500 😭#and yeah i know they always have been stealing from poor people with their maintenance fees and overdraft fees.#but Im supposed to have at least FIVE HUNDRED DOLLARS??? In my account at ALL TIMES????#Why??? what if i need to fucking use that money! What if i want to get my friends and family gifts for birthdays and holidays?

8 notes

·

View notes

Text

Wow, setting up auto deposits and then completely forgetting about your retirement account for a decade really is the way to go. I can definitely recommend Betterment for it's low fees and above average return. Not to make this a weird ad thing, but if you want to try it out here's my referral key: https://www.betterment.com/friend-referral-offer?referral_key=lisajohnson3

If you have a bunch of scattered 401ks from old jobs I can definitely recommend how easy their rollover system is, and it's managed much better than the shitty companies my past jobs paid for.

#this is such a “fandom old” post 🤣#but i use my checking accouny from betterment when i travel abroad because they reimburse all atm fees#and so i just glanced at my 401k account and made cartoon wolf eyes

22 notes

·

View notes

Text

instagram

#financialsuccess#retirementsavings#account#missingmoney#gold 401k rollover#howtorollover#good financial planning#Instagram

8 notes

·

View notes

Text

i mean this in all seriousness.....

every bonus and raise i get at work is cuz i taught myself adobe automation tools and javascript for adobe (even though i took cs in hs like, i could not find a class in what i wanted so i just had to self teach it)

but the only reason i self taught that was cuz i was overly obsessed with kpop

so as long as all my savings accounts are where they should be (percentage of income-wise)... so like 401k, emergency fund, down-payment fund.......(which.....are all invested and/or in high yield 4.5% monthly compounding interest accts and are making their own money)

i can just dump all my disposable income into kpop because if i wasn't unhinged about kpop, i would not have this much disposable income lol

i feel like this is 100% an original meaning of girlmath moment tbh

#personal#i mean i also.....budget like a crazy person and save like....20-25% of my yearly gross income lol#and was doing that when i was broke too......bc im nuts and also bc the same reason my mom was nuts abt saving#(my mom was afraid shed have another stroke so she saved sooo much for retirement...and then did have to#retire early....but not bc of stroke but bc she also had CANCER what the actual fuck#like shes never done drugs and barely drinks and was a professional dancer which is like...a literal athlete..#thats NOT FAIR)#soooo she taught me how to save and invest super early lol.....like she....had me put my#bday money in an investment account every year and i was only allowed to spend interest#(explaining interest on a CD to a 8 year old by saying its a free GBA game lmao)#that was literally how she explained the $30 of interest the cd made i was like...ooo free!! i like free free is good!!#i have like.....enough to cover 2 months of basic bills (not including paychecks coming in) in checking#and then everything else is invested or in high yield.....#im so mad rn bc my 401k isnt doing that great tho....like my high yeild and my brokerage accounts are doing better#like the 401k is pretaxed and i get a very generous employer match of 5% instead of 3% so its worth#putting the money there instead of having it in my paycheck and putting it with the broker#buuuuut its annoying me#like im definitely getting more overall out of putting in 401k....but i wish it was making the same interest as my brokerage is

4 notes

·

View notes

Text

i was clocking in at work once and one of my coworkers turned to me and said "im sorry, im not good at saving my money. i love spending it." i felt like a priest during confession

#mine#people see me and assume i want to know about their savings account and 401k#and i do.#i study finance in college btw#thats why

2 notes

·

View notes

Photo

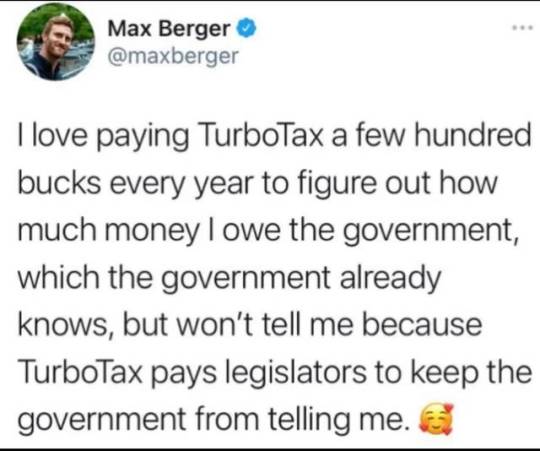

not to be that asshole, but free tax returns are only for ‘simply returns’ meaning you don’t have a retirement fund (401k, etc). which is unlikely if you work full time in the US bc jobs are required to make you a 401k account to save for retirement bc they don’t give us pensions anymore.

#i tried to use Freetaxusa and it wasn’t free bc i had a 401k i didn’t choose to open#the job i had at the time made it for me half way through my employment bc the system finally registered#me as a full time employee which requires them to make a 401k account and start taking part of my checks for saving

149K notes

·

View notes

Text

Don’t talk to me or the $700 in my 401k that I didn’t realize I had until 5 minutes ago ever again

#lol I will never be able to retire#but my hr at work came up to me and was like#hey we updated the company policy on retirement accounts so I wanted to let you know in case you needed to change yours!#and I was like… wut#anyway I have a 401k at work that I apparently contribute to each paycheck#I am ADULTING

0 notes

Text

{ MASTERPOST } Everything You Need to Know about Retirement and How to Retire

How to start saving for retirement

Dafuq Is a Retirement Plan and Why Do You Need One?

Procrastinating on Opening a Retirement Account? Here’s 3 Ways That’ll Fuck You Over.

Season 4, Episode 5: “401(k)s Aren’t Offered in My Industry. How Do I Save for Retirement if My Employer Won’t Help?”

How To Save for Retirement When You Make Less Than $30,000 a Year

Workplace Benefits and Other Cool Side Effects of Employment

Your School or Workplace Benefits Might Include Cool Free Stuff

Do NOT Make This Disastrous Beginner Mistake With Your Retirement Funds

The Financial Order of Operations: 10 Great Money Choices for Every Stage of Life

Advanced retirement moves

How to Painlessly Run the Gauntlet of a 401k Rollover

The Resignation Checklist: 25 Sneaky Ways To Bleed Your Employer Dry Before Quitting

Ask the Bitches: “Can I Quit With Unvested Funds? Or Am I Walking Away From Too Much Money?”

You Need to Talk to Your Parents About Their Retirement Plan

Season 4, Episode 8: “I’m Queer, and Want To Find an Affordable Place To Retire. How Do I Balance Safety With Cost of Living?”

How Dafuq Do Couples Share Their Money?

Ask the Bitches: “Do Women Need Different Financial Advice Than Men?”

From HYSAs to CDs, Here’s How to Level Up Your Financial Savings

Season 3, Episode 7: “I’m Finished With the Basic Shit. What Are the Advanced Financial Steps That Only Rich People Know?”

Investing for the long term

When Money in the Bank Is a Bad Thing: Understanding Inflation and Depreciation

Investing Deathmatch: Investing in the Stock Market vs. Just… Not

Investing Deathmatch: Traditional IRA vs. Roth IRA

Investing Deathmatch: Stocks vs. Bonds

Wait… Did I Just Lose All My Money Investing in the Stock Market?

Financial Independence, Retire Early (FIRE)

The FIRE Movement, Explained

Your Girl Is Officially Retiring at 35 Years Old

The Real Story of How I Paid off My Mortgage Early in 4 Years

My First 6 Months of Early Retirement Sucked Shit: What They Don’t Tell You about FIRE

Bitchtastic Book Review: Tanja Hester on Early Retirement, Privilege, and Her Book, Work Optional

Earning Her First $100K: An Interview with Tori Dunlap

If you found this helpful, consider joining our Patreon.

#personal finance#saving money#retirement#saving for retirement#retirement account#retirement fund#401k#FIRE movement#early retirement#financial independence#investing#stock market#investors

76 notes

·

View notes

Text

A Strategic Approach to College Savings Using Life Insurance for Long-Term Financial Security

Saving for college is a significant financial commitment, and families are constantly seeking strategies to ease this burden. One often overlooked option is saving for college with life insurance. This strategy offers flexibility and financial stability since it not only creates a safety net but also lets cash worth increase with time. Understanding the benefits of a life insurance college fund strategy can help families create a versatile and effective college savings plan.

What is Saving for College with Life Insurance?

Using a permanent life insurance policy—such as whole life or universal life insurance—saving for college with life insurance means building cash worth over time. Permanent life insurance policies generate cash value that is accessible to the policyholder for the duration of their lifetime, whereas term life insurance only offers coverage for a predetermined time. This growing cash value can be borrowed against or withdrawn to help cover the costs of college tuition, books, or other educational expenses.

Why Consider a Life Insurance College Fund Strategy?

A life insurance college fund strategy offers several unique advantages over traditional savings plans. Unlike 529 plans or other college savings accounts, the cash value in a life insurance policy can be used for any purpose, not just education. This flexibility ensures that if your child decides not to attend college, the money can still be utilized for other significant financial goals. Furthermore, the cash value grows tax-deferred, making this strategy a valuable tool for building long-term wealth.

How Does Life Insurance Help with College Savings?

The life insurance college fund strategy is particularly appealing because of the potential for tax-advantaged growth. As premiums are paid into the policy, a portion goes toward building cash value. Over time, this cash value grows, and when it’s time to pay for college, the policyholder can borrow against or withdraw from it. Since loans from life insurance policies are not taxed, it’s a tax-efficient way to access funds for higher education.

Flexibility and Security in College Planning

Unlike traditional college savings vehicles, saving for college with life insurance provides more flexibility. In cases where a child may receive scholarships or choose an alternative career path, the funds in a 529 plan can face tax penalties if used for non-educational purposes. Life insurance, on the other hand, does not have this limitation. The cash value remains available for a wide range of uses, offering financial security beyond education.

Start Early for Maximum Benefits

Starting alife insurance college fund strategy early is crucial for maximizing the benefits. The earlier a policy is purchased, the more time the cash value has to accumulate. By the time college expenses arise, there will be a substantial amount available to cover educational costs. Additionally, starting early ensures lower premiums, making it a more affordable long-term solution for families planning for the future.

Conclusion

Saving for college with life insurance is a flexible and tax-efficient strategy that provides both financial security and peace of mind. With a life insurance college fund strategy, families can build wealth, ensure protection, and fund educational expenses without facing the restrictions of traditional savings plans. Visit retirenowis.com for professional advice to investigate how this strategy might be customized to meet your financial objectives.

Blog Source URL :

#IRA rollover#rollover IRA#401k to IRA rollover#retirement plan rollover#tax-free rollover#rollover retirement funds#retirenow#retire now#Saving for College with Life Insurance#Children’s College Fund Investment#Life Insurance College Fund Strategy#Best Life Insurance for College Savings#College Savings Plans with Life Insurance#Investing in Life Insurance for College#Life Insurance as College Fund#Financial Planning for College with Life Insurance#Tax Benefits of Life Insurance for College Savings#Life Insurance Investment for Education Fund#College Fund Financial Consulting#Life Insurance College Savings Plan#IRA Rollover Guide#Roth IRA Rollover Process#Retirement Account Rollover#How to Rollover 401(k) to IRA#Roth IRA Conversion#IRA Rollover Rules#Rollover IRA vs. Roth IRA#401(k) to Roth IRA Rollover#IRA Rollover Financial Consulting#Best IRA Rollover Options

0 notes

Text

Always put as much as the company will match if you can! This is standard advice and they were being assholes to concern troll like that.

Pensions sound so fake as a zillennial. You work for one place for decades (already sounds fake) and then afterwards you leave and they just. keep paying you. the same amount of money. to do nothing. for the rest of your life. if i wasn't already aware that this was something that readily and commonly existed during my grandparent's days then it would sound like some kind of socialist pipe dream

#i am on a weird education pension plan now#it's not quite a matching system and I don't just get my money back#there's a whole percentages and final pay rate thing so the longer i stay in the job the better my retirement from them is#which is a lot different from the 401k type thing where it's mostly your own money plus investment returns#retirement accounts are overly obfucsated and it's really annoying that we have to worry about it at all

39K notes

·

View notes

Text

Did you know that you can use a tax strategy to hire your children as your company employees, allowing you to transfer wealth while reducing taxes.

1. Children 8 years and older can work at your business.

2. Base your children's wages on a market standard.

3. Pay your children in exchange for legitimate services.

For payments made to children:

1. Under 18, exempt from Social Security and Medicare taxes.

2. Under 21, exempt from FUTA taxes.

Regardless of your child's age or the type of business entity, tax for your child's earnings is withheld.

0 notes

Text

NO MORE SCENIC!!

NO MORE SCENIC!!

NO MORE SCENIC!!

MARITZA CAN SUCK MY ASS!

#finally got my 401k rolled over into my new jobs’ account#it was supposed to be done back in August last year#but they were stupid and didn’t send it in time#so I had to do basically everything on my own#and I checked today after stupid Maritza called me and left a voicemail while I was at work#and I just got to look at my account and it’s there#most of it anyway#so now all ties have been cut#I want nothing else to do with them after the way they treated me#and wrongfully terminated me from my job of 10 years and 4 months#and banned me for ‘being violent’ which I’m not#you can only take so much of people insulting you and telling you that you’re doing the job wrong when you aren’t#and having supervisors/shift leads hover over you while you’re working because they’re waiting for you to do something they don’t like#so that they can move you to a different area of the building#or a different building entirely#without telling you why#so MARITZA CAN SUCK MY FAT ASS

0 notes

Text

Unlock Your Financial Future with RolloverWise

Experience the ease of managing your retirement accounts with RolloverWise. Our comprehensive services simplify the complex task of overseeing your financial future. We specialize in locating forgotten 401(k) accounts, ensuring no savings are left behind. Facilitating seamless rollovers, we make transitions effortless, and our expert guidance ensures you navigate the intricacies of retirement planning with confidence. Trust RolloverWise to streamline your financial journey, providing the support and services you need for a secure and optimized retirement.

Visit Now: https://www.rolloverwise.com/

1 note

·

View note